We need the future of auto insurance today

The Peltzman effect and why driving is getting more dangerous, not safer

Quick summary:

After a meaningful reduction in severe accidents and injuries from 1999-2009, the past decade saw regression in the form of increased auto accidents

Setting aside the COVID period where mobility was limited, distracted driving appears to be fueling an increase in severe injuries and pedestrian fatalities

This increase in severe accidents comes even as OEMs have introduced many new safety features designed to reduce the frequency and severity of accidents

The increase in frequency from 2010-2019 combined with persistent increases in severity led to challenging loss trends for the auto insurance industry

The Peltzman effect may explain the rise of riskier driving behaviors as well as broader risk taking in areas such as health and financial investments

I recently attended the Insurtech Insights USA event held in New York City a couple of weeks ago and had the privilege of moderating two panels and a roundtable discussion. One of the panels was a terrific conversation on “the future of the American automobile” and its implications for the auto insurance marketplace. While it was exciting to spend 30 minutes talking about the rise of telematics, the increasing popularity of pay-per-mile, the use of gamification, the role of OEMs as insurance providers and distribution channels, and the future of connected vehicles and infrastructure, the reality is today there is a growing crisis on the roadways. I’ll highlight accident trends in the United States below, but intrepid readers can likely find similar statistics for other countries that are anecdotally seeing similar trends. This is not good news, especially as people hit the roads to enjoy a much-needed vacation this summer.

The accident trend is not our friend

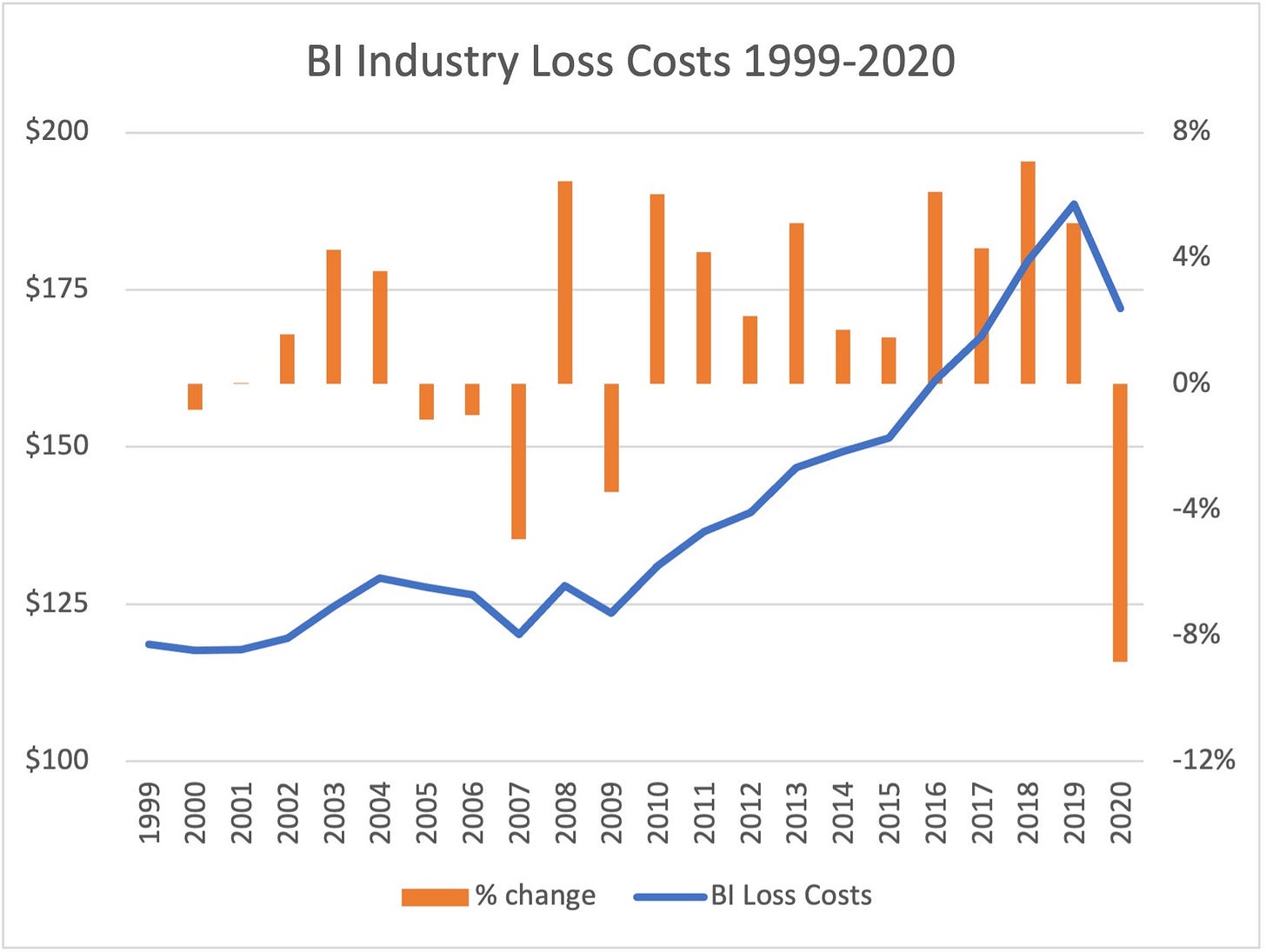

In the late 2000s, I worked as the Auto Portfolio Manager for USAA, a top ten personal lines carrier in the U.S. At that time, we noticed an interesting trend: claims frequency was on a multi-year decline while claims severity was rising. Based on data retrieved from the Insurance Information Institute (III) sourced to ISO/Verisk, I recently calculated that there was an annualized decrease in bodily injury (BI) frequency of -3.2% and annualized increase in claims severity of +3.7% from 1999-2009, which led to a slight annualized increase in losses of +0.4% for this period. The common story we told at the time was that improvements in vehicle safety features such as anti-lock brakes as well as societal changes such as decreases in drunk driving and stricter seats belt laws were combining to meaningfully reduce the number of serious accidents. Some of these safety features led to more expensive repairs such as dual air bags and sensors deployed on vehicle bumpers, but overall the tradeoff between fewer injuries and more expensive repairs was worth it. According to the National Highway Traffic Safety Administration (NHTSA), fatalities reached a multi-decade low in 2010. Cumulatively, advances in vehicle safety features were estimated by NHTSA to reduce the risk of fatality by 56% in 2012 from the 1950s and saving over 600,000 lives from the time period from 1960 to 2012.

Driving became more dangerous in the 2010s

Further advances in vehicle safety technology were made in the 2010s including electronic stability control (ESC), widespread use of backup cameras, blind spot detection, and a host of automated driver assistance systems (ADAS) such as lane departure warnings, forward collision warnings and automated emergency braking. Yet during this decade, both fatalities and BI frequency more generally rose higher. According to NHTSA, overall fatalities in the U.S. rose from 32,479 in 2011 to 42,915 in 2021 (estimated), a 32% increase. Even adjusted for miles driven, there was a 21% increase in the fatality rate. You can see the changes over time from this chart from NHTSA published in their recent report titled Early Estimates of Motor Vehicle Traffic Fatalities in 2021.

The 2021 estimate of fatalities represents the highest number of fatalities since 2005, a 16-year high. In addition to this recent sad news about the overall number of vehicle fatalities, the Governors Highway Safety Association recently reported that the number of pedestrian fatalities was over 7,400 in 2021, a 40-year high. The Center for Disease Control estimates that 1 in 6 fatalities was a pedestrian in 2020.

Source: Insurance Information Institute (III). Note: claim frequency is claims per 100 earned car years

Source: Insurance Information Institute data used in calculations.

The Peltzman effect and risky driving behaviors

So what’s going on? Why are vehicles getting safer yet more serious accidents occurring? Russ Martin, senior director of policy and government relations for the Governors Highway Safety Association, cited an increase in dangerous driving during the pandemic - including speeding, distracted driving, drug and alcohol use, and not buckling up - as reasons according to a recent Axios article. U.S. Transportation Secretary Pete Buttigieg recently stated, “we face a crisis on America’s roadways that we must solve together”, in announcing an additional $740 million in federal grants to states and communities to help address risky driving behaviors.

Two main theories are emerging on what is driving the increase in severe accidents. The first is the need for improved driver education on recent safety features that have been added to vehicles. According to the AAA Foundation, a “learn as you go” approach using ADAS leaves critical gaps in knowledge compared with drivers who receive more formal training on how to leverage the technology. Scientific studies have shown that drivers can be over-reliant on vehicles that have Level 2 autonomous driving features, and organizations such as the National Transportation Safety Board in the U.S. and the European Transport Safety Council have expressed concerns with driver awareness and engagement with ADAS.

The second theory is broader and is known as risk compensation or the Peltzman effect after economist Sam Peltzman and the publication of his study in 1975 titled “The Effects of Automobile Safety Regulation”. Peltzman looked at improved vehicle safety technology and increased seat belt use in the 1960s to determine the impact that they had on roadway safety. Surprisingly, Peltzman found there was no decrease in automobile deaths and theorized that the reason was because drivers were compensating for the increase in safety by engaging in riskier driving behaviors. Since his landmark study, many other studies have been conducted and the Peltzman effect has been found to apply in other domains as well even as his original study led to controversy. For example, researchers have found that the development of COVID-19 vaccines resulted in fewer people following social distancing and masking guidelines.

Telematics is one of the technological solutions that insurance companies have embraced to address risky driving behavior by capturing granular data from the vehicle itself including incidents of speeding, hard braking, sharp turns, and more. According to a recent study published by Cambridge Mobile Telematics (CMT), there was a 30% rise in the amount of distracted driving in February 2022 as compared with February 2020, the first month prior to the pandemic arriving full force in the U.S. CMT estimates that the average driver is distracted by their phone for 1 minute, 38 seconds per driving hour. Many insurers have embraced telematics and provide a risk score that impacts the premium they are charged, including Tesla Insurance where drivers begin with a risk score of 90 and the score goes up or down based on their driving behaviors. Commercial fleets in particular have embraced telematics and hope that it leads to a meaningful reduction in serious accidents. Yet to date, the increased adoption of telematics by U.S. drivers has not resulted in an overall reduction in the number of fatalities on the roads. The modification of risky behavior in the presence of safer systems, it seems, remains elusive.

What can be done in your view to turn the trend of increased severe accidents and fatalities around? Will widespread adoption of telematics have a meaningful impact? What about fully autonomous Level 5 vehicles? Some speculate that fewer drivers on the road led to more speeding on previously congested freeways. Will this change as people return to the office?

Nice article, Rob. I do think lack of driver education and riskier behavior / distracted driving could explain some of the trend I think there are some other important variables to consider. Two came to mind reading your article: (1) vehicle size and weight and (2) medical inflation. Vehicles today are obscenely big and heavy. 4000lb car moving at 50mph has a lot more potential energy (severity) than a 2000lb. Car weights have been increasing steadily which would explain more severity. Medical inflation has also been increasing steadily - I'd be interested to see the III chart adjusted for med inflation.